The establishment of businesses is also favoured by various programs relaunched by the French state such as France Relance. This policy of attractiveness and other measures taken to facilitate the holding of real estate by foreigners (abolition of the obligation to appoint a tax representative, for example) boosts investments in French real estate.

The market for foreign buyers of RE in France represents 17.7 billion euros but the health crisis, the lockdowns, the hardening of the borders have dealt a blow to the number of real estate transactions. The real estate market is marked by stop & go. At the beginning of 2020, before the health crisis, 17% of requests came from international buyers. This figure fell to 10% during the first lockdown in March. It then rose sharply over the summer period with a peak of 15% in July, before falling to 10% in December and 8.6% in January 2021. The majority of requests from non-resident buyers come from border countries:

- Belgium 23%,

- United Kingdom 19%,

- Germany 12%,

- Netherlands 9%,

- Switzerland 6%,

- Spain 2%,

- Italy 2%.

The motivations of foreign buyers on the French real estate market vary:

- 42% of them are looking for a secondary residence in France,

- 39% move to France and seek their main residence,

- 10% want to invest in the French real estate market (especially in Paris).

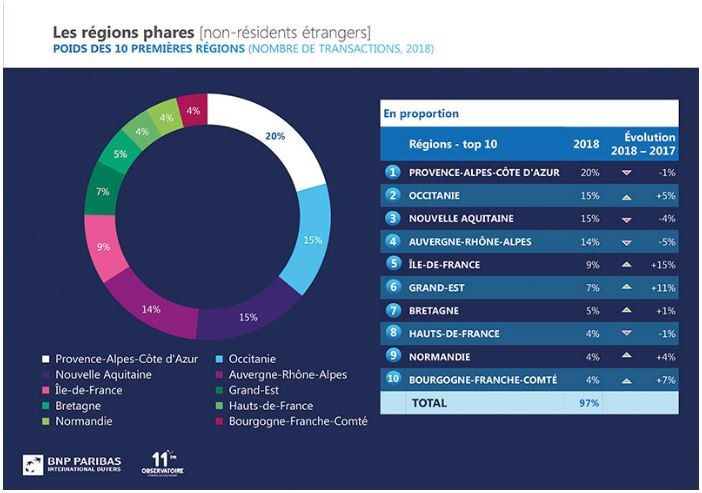

The regions where life is good are particularly popular with this clientele. Over the past year, these investors' research has jumped by 379% in Corsica, 45% in Provence-Alpes-Côte d'Azur, and 35% in Burgundy-Franche-Comté. An increase is observed in Occitanie + 15% and Ile-de-France +9%. The increase in the number of transactions in Paris is due to price decreases per m2. The SUD region (PACA) continues to lead the rankings with 20% of transactions conducted by foreign non-residents – down slightly.

Any investor must ask himself the question of the holding of his real estate investment and more particularly foreign investors and/or French expatriates. Rosemont International will be happy to support you in your real estate investment projects.

Holding a real estate

The French or Monegasque tax and legal environment must be taken into account, depending on whether it involves the acquisition of property in France or Monaco. Although an individual may purchase real estate in his own name in France or Monaco, it may be advantageous from a tax, legal or estate planning point of view to structure the acquisition and holding of such property through an SCI.

Why use SCI to acquire real estate?

While a Monegasque SCI may acquire property in France or Monaco, a French SCI is only recommended for the acquisition and structuring of properties located in France.

The following should be considered:

Estate considerations: France and Monaco

Monegasque and French laws reserve an important part of the succession («hereditary reserve») to a class of beneficiaries designated by law.

The law also sets out a priority for children over the surviving spouse. The use of an SCI can avoid the application of these rules and allow for greater flexibility in the choice of heirs, while protecting the surviving spouse.

Fiscal considerations : France

Impôt sur la fortune immobilière (IFI)(annual tax) – You are subject to the real estate wealth tax (IFI) if the net value of your real estate assets exceeds €1.3 million. This patrimony includes all property and real estate rights held directly and indirectly on 1 January. Some goods are partially or totally exempt. Some debts can be deducted from the value of your wealth before taxation.

Inheritance tax on and gifts The rate is determined by the relationship between the heir/donee and the deceased/donor, e.g. wife, child, etc. The tax is payable by the beneficiary. After deduction of allowances, the French rate varies from 5% for persons with a direct link with the deceased/donor (1st tranche) to 60% where there is no family link between the deceased/donor and the beneficiary.

Fiscal considerations: Monaco

In Monaco there is no wealth tax, and no tax on personal capital gains. On the other hand, the tax on estates and donations is levied, except between spouses, ascendants or descendants of the deceased/donor. The rates are significantly lower than the French rates, with a maximum rate of 16% for donations/estates to a beneficiary not related to the deceased/donor.

The sale of Monegasque SCI shares is subject to proportional registration rights in Monaco.

The registration fees due on the acquisition of real estate in Monaco were reviewed in June 2011. Two rates are applicable since 01.07.2011: 7.5% and 4.5% depending on the structuring of the acquisition.

Monegasque and French laws reserve an important part of the succession («hereditary reserve») to a class of beneficiaries designated by law.

The law also sets out a priority for children over the surviving spouse. The use of an SCI can avoid the application of these rules and allow for greater flexibility in the choice of heirs, while protecting the surviving spouse.

Fiscal considerations : France

Impôt sur la fortune immobilière (IFI)(annual tax) – You are subject to the real estate wealth tax (IFI) if the net value of your real estate assets exceeds €1.3 million. This patrimony includes all property and real estate rights held directly and indirectly on 1 January. Some goods are partially or totally exempt. Some debts can be deducted from the value of your wealth before taxation.

Inheritance tax on and gifts The rate is determined by the relationship between the heir/donee and the deceased/donor, e.g. wife, child, etc. The tax is payable by the beneficiary. After deduction of allowances, the French rate varies from 5% for persons with a direct link with the deceased/donor (1st tranche) to 60% where there is no family link between the deceased/donor and the beneficiary.

Fiscal considerations: Monaco

In Monaco there is no wealth tax, and no tax on personal capital gains. On the other hand, the tax on estates and donations is levied, except between spouses, ascendants or descendants of the deceased/donor. The rates are significantly lower than the French rates, with a maximum rate of 16% for donations/estates to a beneficiary not related to the deceased/donor.

The sale of Monegasque SCI shares is subject to proportional registration rights in Monaco.

The registration fees due on the acquisition of real estate in Monaco were reviewed in June 2011. Two rates are applicable since 01.07.2011: 7.5% and 4.5% depending on the structuring of the acquisition.

If you have questions concerning the real estate purchase structuring and holding don’t hesitate to contact us at consulting@rosemont.mc